El Aguila Insurance is a leading provider in the insurance industry, known for its commitment to offering reliable and comprehensive coverage options to meet diverse needs. Established with the mission to protect individuals and families from unforeseen circumstances, El Aguila Insurance has carved a niche for itself in the market. This article will delve into everything you need to know about El Aguila Insurance, from its services and benefits to customer testimonials and expert insights.

In a world where uncertainties are a part of life, having the right insurance is crucial. El Aguila Insurance stands out for its customer-centric approach, ensuring that clients receive tailored solutions that fit their unique situations. Whether you are looking for personal, commercial, or specialized coverage, this company has something to offer everyone.

This comprehensive guide will explore the various aspects of El Aguila Insurance, including its history, types of coverage, claims process, and much more. If you're considering El Aguila Insurance for your protection needs, you’re in the right place!

Table of Contents

History of El Aguila Insurance

Founded in [Year], El Aguila Insurance has grown from a small local provider to a prominent player in the insurance sector. The company was born out of a desire to fill the gaps in the market by offering personalized service and a wide range of insurance products.

Company Milestones

- Year X: Foundation of El Aguila Insurance

- Year Y: Expansion to new regions

- Year Z: Introduction of innovative insurance products

Types of Coverage Offered

El Aguila Insurance provides a diverse array of coverage options to cater to different needs. Here are some of the key types of insurance offered:

Personal Insurance

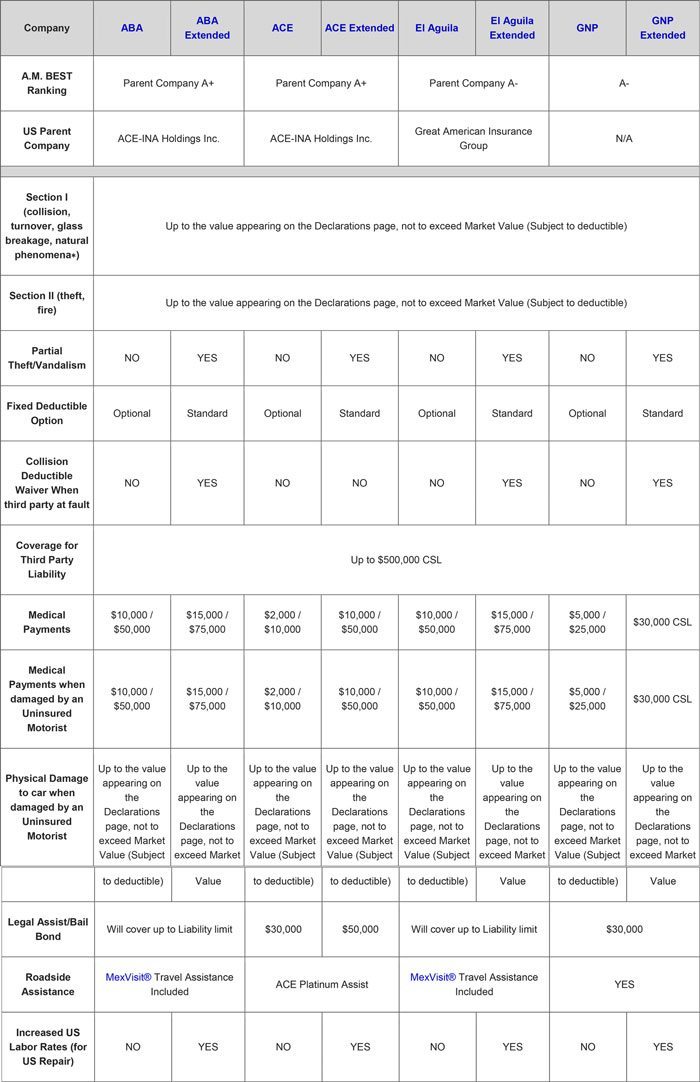

- Auto Insurance: Comprehensive coverage for vehicles, including liability and collision options.

- Homeowners Insurance: Protection for homes and personal property against damage and theft.

- Health Insurance: Various plans that cover medical expenses and health-related costs.

Commercial Insurance

- Business Liability Insurance: Coverage to protect businesses against claims of negligence.

- Property Insurance: Safeguarding commercial property against damage and loss.

- Workers' Compensation: Insurance for employees injured on the job.

Specialized Insurance

- Travel Insurance: Protection against trip cancellations and medical emergencies while traveling.

- Life Insurance: Financial security for families in the event of a policyholder's death.

Understanding the Claims Process

The claims process at El Aguila Insurance is designed to be straightforward and efficient. Here’s a step-by-step guide on how to file a claim:

Customer Reviews and Testimonials

Customer satisfaction is a top priority at El Aguila Insurance. Here are some testimonials from satisfied clients:

- "I had a great experience with El Aguila Insurance! Their team was supportive and helped me through the claims process." - Jane D.

- "El Aguila offers competitive rates and excellent customer service. Highly recommend!" - John S.

Expert Insights on Insurance Needs

Experts recommend assessing your insurance needs regularly to ensure you have adequate coverage. Here are some tips:

- Review your policies annually to ensure they meet your current needs.

- Consider bundling multiple policies for discounts.

- Consult with an insurance agent to discuss any changes in your situation.

Benefits of Choosing El Aguila Insurance

Choosing El Aguila Insurance comes with numerous advantages, including:

- Personalized Service: Tailored coverage options that suit individual needs.

- Competitive Pricing: Affordable rates without compromising on coverage quality.

- Expert Guidance: Access to knowledgeable agents who can help you navigate the insurance landscape.

If you’re interested in learning more about El Aguila Insurance or want to get a quote, here’s how you can reach them:

| Contact Method | Details |

|---|---|

| Phone | (123) 456-7890 |

| info@elaguila.com | |

| Website | www.elaguila.com |

Conclusion

In summary, El Aguila Insurance is a reliable option for anyone seeking comprehensive coverage that meets their specific needs. With a rich history, diverse insurance products, and a commitment to customer satisfaction, this company stands out in the insurance landscape. We encourage you to reach out, explore your options, and see how El Aguila Insurance can provide the protection you need.

If you found this article helpful, please leave a comment below, share it with others, or explore more articles on our site for further information!

Thank you for reading, and we hope to see you again soon!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmp52nqLCwvsRubmidnGKuqMHIpZhmoZ6owrOtzZycZ6Ckork%3D